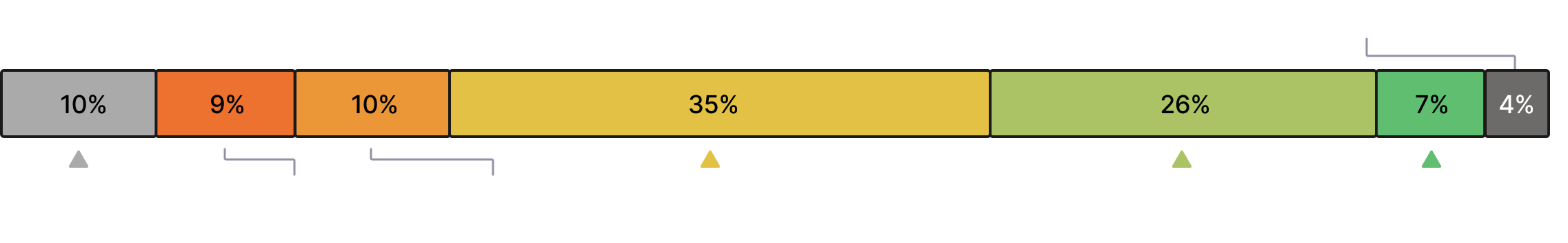

Tool overload

is real

101

different observability technologies

cited as being currently in use

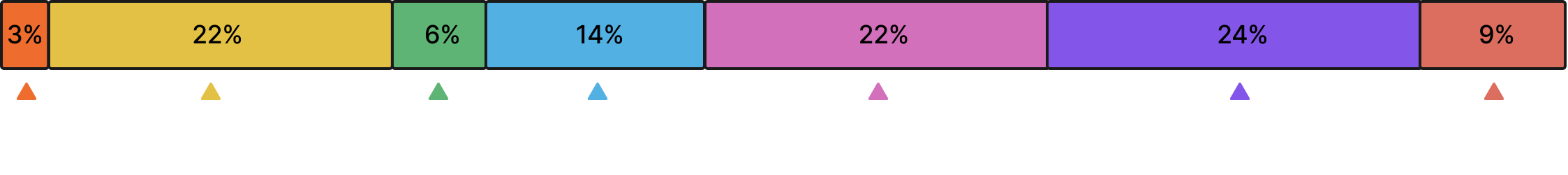

Observability runs

on OSS

71%

of organizations say they’re using

Prometheus and OpenTelemetry in

some capacity†

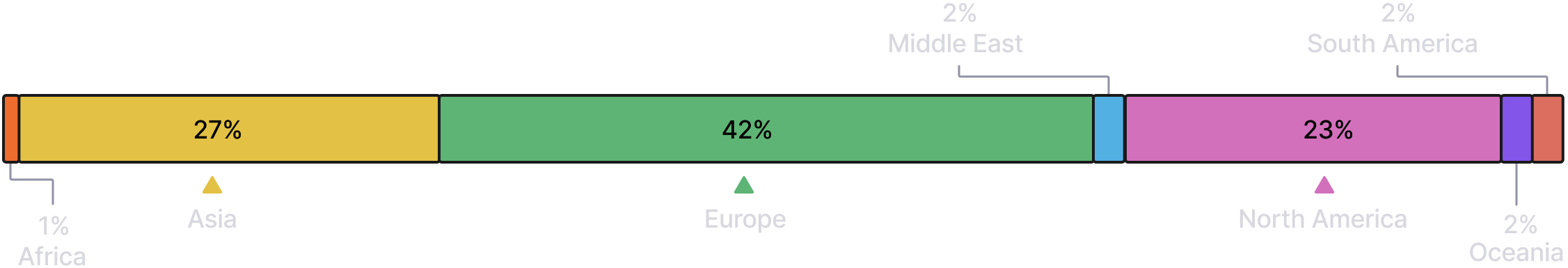

Cost dominates buying

decisions

74%

say it’s a top priority for selecting

tools, ahead of ease of use and

interoperability

Complexity

chaos

39%

say complexity/overhead is their

biggest observability obstacle—the

most frequently cited impediment

Full stack to

the fore

85%

of companies are using unified

infrastructure and application

observability in some capacity†

A view from

the top

49%

say the “CTO/C-level” or “VP-level”

is the highest level at which

observability is considered

critical to the business