Candlestick

The candlestick visualization allows you to visualize data that includes a number of consistent dimensions focused on price movements, such as stock prices. The candlestick visualization includes an Open-High-Low-Close (OHLC) mode, as well as support for additional dimensions based on time series data.

Candlestick visualizations build upon the foundation of the time series visualization and include many common configuration settings.

You can use a candlestick if you want to visualize, at a glance, how a price moved over time, whether it went up, down, or stayed the same, and how much it fluctuated:

Each candlestick is represented as a rectangle, referred to as the candlestick body. The candlestick body displays the opening and closing prices during a time period. Green candlesticks represent when the price appreciated while the red candlesticks represent when the price depreciated. The lines sticking out the candlestick body are referred to as wicks or shadows, which represent the highest and lowest prices during the time period.

Use a candlestick when you need to:

- Monitor and identify trends in price movements of specific assets such as stocks, currencies, or commodities.

- Analyze any volatility in the stock market.

- Provide data analysis to help with trading decisions.

Configure a candlestick

Once you’ve created a dashboard, the following video shows you how to configure a candlestick visualization:

With Grafana Play, you can explore and see how it works, learning from practical examples to accelerate your development. This feature can be seen on Candlestick.

Supported data formats

The candlestick visualization works best with price movement data for an asset. The data must include:

- Timestamps - The time at which each price movement occurred.

- Opening price - The price of the asset at the beginning of the time period.

- Closing price - The price of the asset at the end of the time period.

- Highest price - The highest price the asset reached during the time period.

- Lowest price - The lowest price the asset reached during the time period.

Example

The data is converted as follows:

Configuration options

The following section describes the configuration options available in the panel editor pane for this visualization. These options are, as much as possible, ordered as they appear in Grafana.

Panel options

In the Panel options section of the panel editor pane, set basic options like panel title and description, as well as panel links. To learn more, refer to Configure panel options.

Candlestick options

The following options let you control which data is displayed in the visualization and how it appears:

Color strategy

The Color strategy option controls how colors are applied to dimensions. Choose from:

Since Open - The default behavior. This mode uses the Up color if the intra-period price movement is positive. In other words, if the value on close is greater or equal to the value on open, the Up color is used.

Since Prior Close - An alternative display method where the color of the candle is based on the inter-period price movement or change in value. In other words, if the value on open is greater than the previous value on close, the Up color is used. If the value on open is lower than the previous value on close, the Down color is used.

This option also triggers the hollow candlestick visualization mode. Hollow candlesticks indicate that the intra-period movement is positive (value is higher on close than on open), while filled candlesticks indicate the intra-period change is negative (value is lower on close than on open). To learn more, refer to the explanation of the differences.

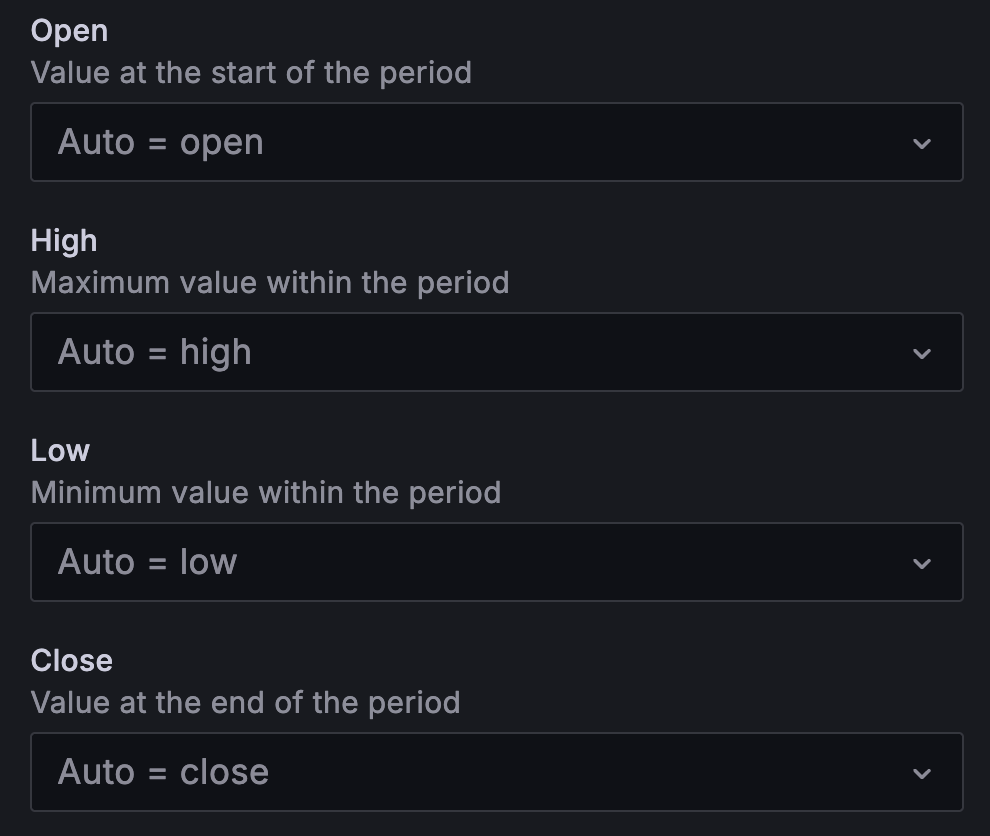

Open, High, Low, Close, Volume

The candlestick visualization attempts to map fields from your data to the appropriate dimension:

- Open - Starting value of the given period.

- High - Highest value of the given period.

- Low - Lowest value of the given period.

- Close - Final (end) value of the given period.

- Volume - Sample count in the given period (for example, number of trades).

Note

The candlestick visualization legend doesn’t display these values.

If your data can’t be mapped to these dimensions for some reason (for example, because the column names aren’t the same), you can map them manually using the Open, High, Low, and Close fields under the Candlestick options in the panel editor:

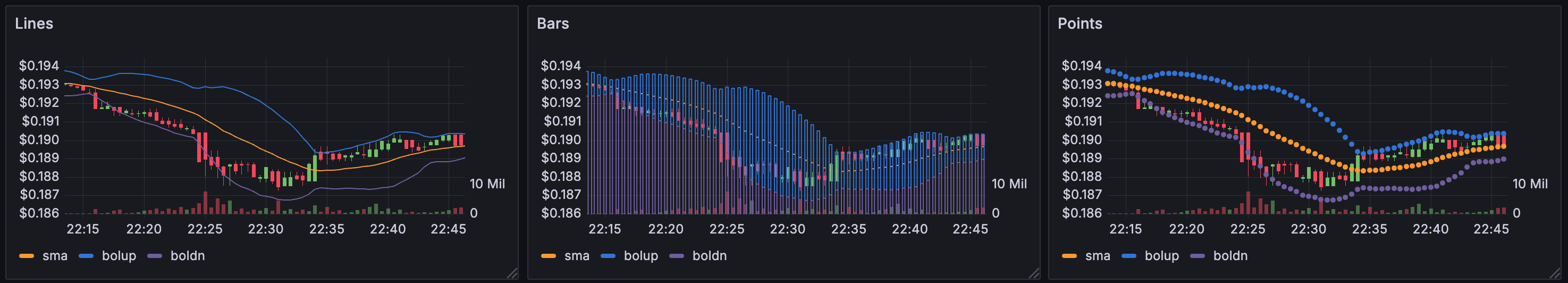

Additional fields

The candlestick visualization is based on the time series visualization, and it can visualize additional data dimensions beyond open, high, low, close, and volume. The Include and Ignore options allow it to visualize other included data such as simple moving averages, Bollinger bands and more, using the same styles and configurations available in the time series visualization.

Tooltip options

Tooltip options control the information overlay that appears when you hover over data points in the visualization.

Tooltip mode

When you hover your cursor over the visualization, Grafana can display tooltips. Choose how tooltips behave.

- Single - The hover tooltip shows only a single series, the one that you are hovering over on the visualization.

- All - The hover tooltip shows all series in the visualization. Grafana highlights the series that you are hovering over in bold in the series list in the tooltip.

- Hidden - Do not display the tooltip when you interact with the visualization.

Use an override to hide individual series from the tooltip.

Values sort order

When you set the Tooltip mode to All, the Values sort order option is displayed. This option controls the order in which values are listed in a tooltip. Choose from the following:

- None - Grafana automatically sorts the values displayed in a tooltip.

- Ascending - Values in the tooltip are listed from smallest to largest.

- Descending - Values in the tooltip are listed from largest to smallest.

Hover proximity

Set the hover proximity (in pixels) to control how close the cursor must be to a data point to trigger the tooltip to display. The following screen recording shows this option in a time series visualization:

Legend options

Legend options control the series names and statistics that appear under or to the right of the graph. For more information about the legend, refer to Configure a legend.

Graph styles options

The options under the Graph styles section let you control the general appearance of additional fields in the visualization, excluding color.

Style

Choose whether to display your time-series data as Lines, Bars, or Points. You can use overrides to combine multiple styles in the same graph. Choose from the following:

Line interpolation

Choose how the graph interpolates the series line:

- Linear - Points are joined by straight lines.

- Smooth - Points are joined by curved lines that smooths transitions between points.

- Step before - The line is displayed as steps between points. Points are rendered at the end of the step.

- Step after - The line is displayed as steps between points. Points are rendered at the beginning of the step.

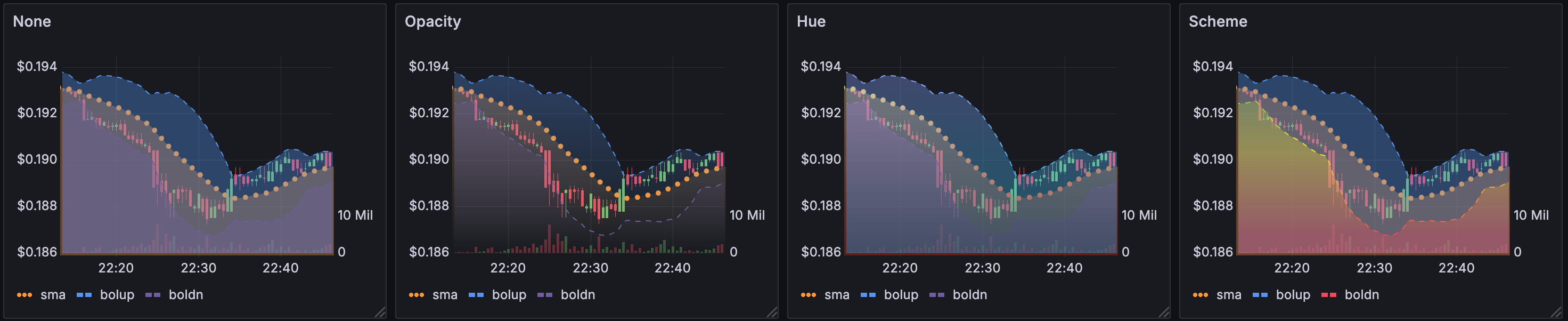

Gradient mode

Choose a gradient mode to control the gradient fill, which is based on the series color. To change the color, use the standard color scheme field option. For more information, refer to Color scheme.

- None - No gradient fill. This is the default setting.

- Opacity - An opacity gradient where the opacity of the fill increases as y-axis values increase.

- Hue - A subtle gradient that’s based on the hue of the series color.

- Scheme - A color gradient defined by your Color scheme. This setting is used for the fill area and line. For more information about scheme, refer to Scheme gradient mode.

Gradient appearance is influenced by the Fill opacity setting. The following image shows the Fill opacity set to 50.

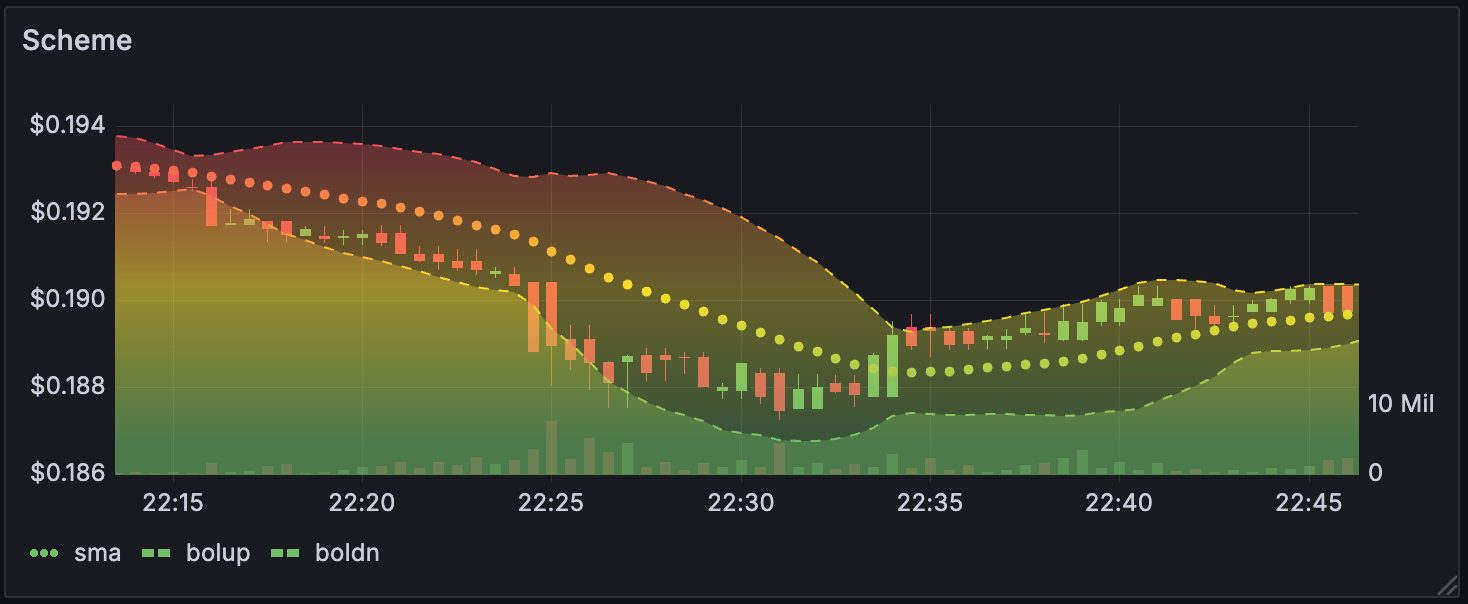

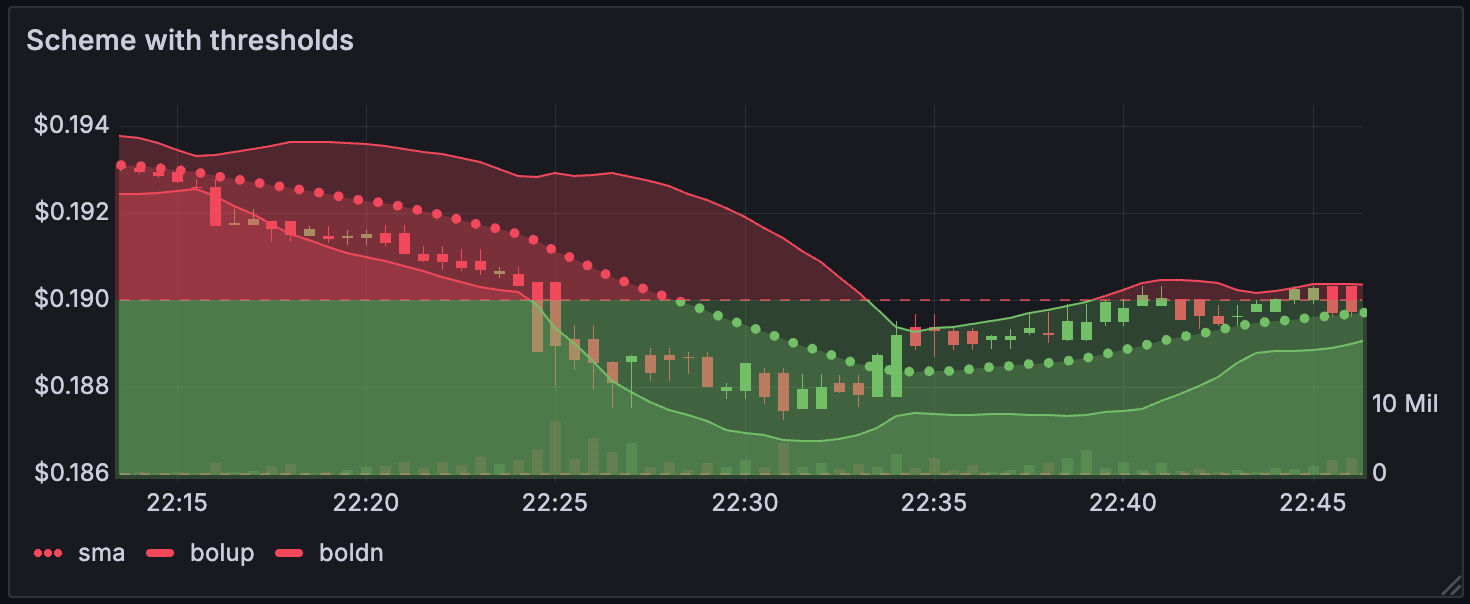

Scheme gradient mode

In Scheme gradient mode, the line or bar receives a gradient color defined from the selected Color scheme option in the visualization’s Standard options.

The following image shows a line chart with the Green-Yellow-Red (by value) color scheme option selected:

If the Color scheme is set to From thresholds (by value) and Gradient mode is set to Scheme, then the line or bar color changes as it crosses the defined thresholds:

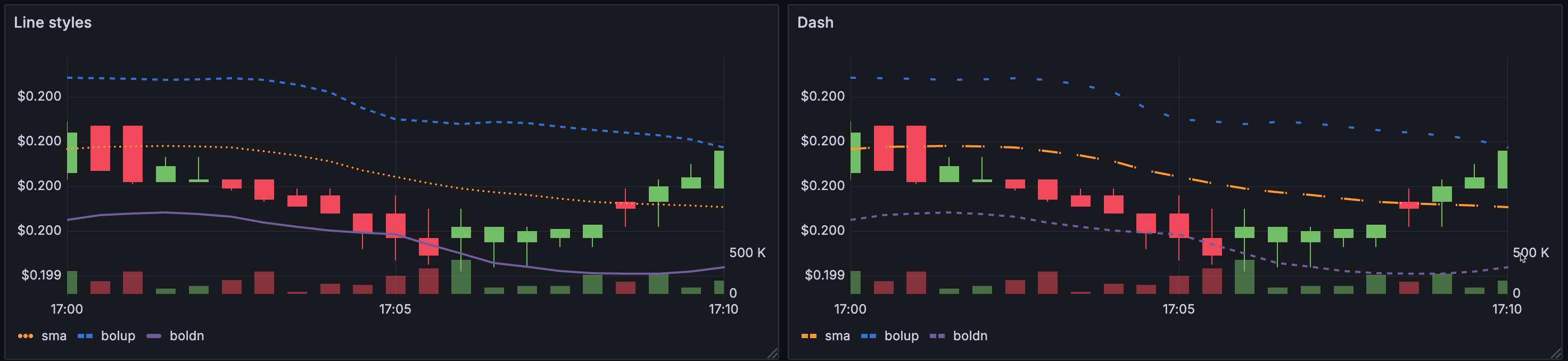

Line style

Choose a solid, dashed, or dotted line style:

- Solid - Display a solid line. This is the default setting.

- Dash - Display a dashed line. When you choose this option, a list appears for you to select the length and gap (length, gap) for the line dashes. Dash spacing is 10, 10 by default.

- Dots - Display dotted lines. When you choose this option, a list appears for you to select the gap (length = 0, gap) for the dot spacing. Dot spacing is 0, 10 by default.

Connect null values

Choose how null values, which are gaps in the data, appear on the graph. Null values can be connected to form a continuous line or set to a threshold above which gaps in the data are no longer connected.

- Never - Time series data points with gaps in the data are never connected.

- Always - Time series data points with gaps in the data are always connected.

- Threshold - Specify a threshold above which gaps in the data are no longer connected. This can be useful when the connected gaps in the data are of a known size and/or within a known range, and gaps outside this range should no longer be connected.

Disconnect values

Choose whether to set a threshold above which values in the data should be disconnected.

- Never - Time series data points in the data are never disconnected.

- Threshold - Specify a threshold above which values in the data are disconnected. This can be useful when desired values in the data are of a known size and/or within a known range, and values outside this range should no longer be connected.

To change the color, use the standard color scheme field option.

Show points

Set whether to show data points as lines or bars. Choose from the following:

- Auto - Grafana determines a point’s visibility based on the density of the data. If the density is low, then points appear.

- Always - Show the points regardless of how dense the dataset is.

- Never - Don’t show points.

Stack series

Set whether Grafana stacks or displays series on top of each other. Be cautious when using stacking because it can create misleading graphs. To read more about why stacking might not be the best approach, refer to The issue with stacking. Choose from the following:

- Off - Turns off series stacking. When Off, all series share the same space in the visualization.

- Normal - Stacks series on top of each other.

- 100% - Stack by percentage where all series add up to 100%.

Stack series in groups

The stacking group option is only available as an override. For more information about creating an override, refer to Configure field overrides.

Edit the panel and click Overrides.

Create a field override for the Stack series option.

In stacking mode, click Normal.

Name the stacking group in which you want the series to appear.

The stacking group name option is only available when you create an override.

Bar alignment

Set the position of the bar relative to a data point. In the examples below, Show points is set to Always which makes it easier to see the difference this setting makes. The points don’t change, but the bars change in relationship to the points. Choose from the following:

- Before

![Bar alignment before icon]() The bar is drawn before the point. The point is placed on the trailing corner of the bar.

The bar is drawn before the point. The point is placed on the trailing corner of the bar. - Center

![Bar alignment center icon]() The bar is drawn around the point. The point is placed in the center of the bar. This is the default.

The bar is drawn around the point. The point is placed in the center of the bar. This is the default. - After

![Bar alignment after icon]() The bar is drawn after the point. The point is placed on the leading corner of the bar.

The bar is drawn after the point. The point is placed on the leading corner of the bar.

Axis options

Options under the Axis section control how the x- and y-axes are rendered. Some options don’t take effect until you click outside of the field option box you’re editing. You can also press Enter.

Placement

Select the placement of the y-axis. Choose from the following:

- Auto - Automatically assigns the y-axis to the series. When there are two or more series with different units, Grafana assigns the left axis to the first unit and the right axis to the units that follow.

- Left - Display all y-axes on the left side.

- Right - Display all y-axes on the right side.

- Hidden - Hide all axes. To selectively hide axes, Add a field override that targets specific fields.

Scale

Set the y-axis values scale. Choose from:

- Linear - Divides the scale into equal parts.

- Logarithmic - Use a logarithmic scale. If you select this option, in the Log base list, choose a binary (base 2) or common (base 10) logarithmic scale.

- Symlog - Use a symmetrical logarithmic scale. If you select this option, choose also:

- Log base - Select a binary (base 2) or common (base 10) logarithmic scale.

- Linear threshold - Set the threshold at which the scale changes from linear to logarithmic.

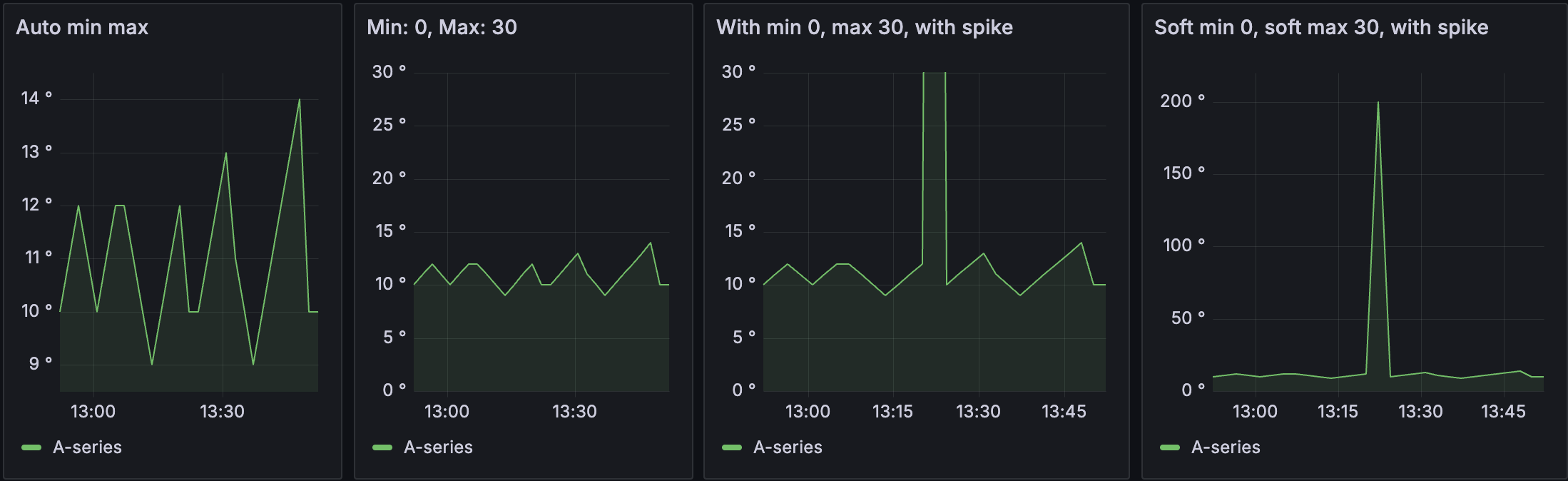

Soft min and soft max

Set a Soft min or soft max option for better control of y-axis limits. By default, Grafana sets the range for the y-axis automatically based on the dataset.

Soft min and soft max settings can prevent small variations in the data from being magnified when it’s mostly flat. In contrast, hard min and max values help prevent obscuring useful detail in the data by clipping intermittent spikes past a specific point.

To define hard limits of the y-axis, set standard min/max options. For more information, refer to Configure standard options. The following examples shows how this option works in a time series visualization:

Standard options

Standard options in the panel editor pane let you change how field data is displayed in your visualizations. When you set a standard option, the change is applied to all fields or series. For more granular control over the display of fields, refer to Configure overrides.

To learn more, refer to Configure standard options.

Data links and actions

Data links allow you to link to other panels, dashboards, and external resources and actions let you trigger basic, unauthenticated, API calls. In both cases, you can carry out these tasks while maintaining the context of the source panel.

For each data link, set the following options:

- Title

- URL

- Open in new tab

- One click - Opens the data link with a single click. Only one data link can have One click enabled at a time.

For each action, define the following API call settings:

To learn more, refer to Configure data links and actions.

Value mappings

Value mapping is a technique you can use to change how data appears in a visualization.

For each value mapping, set the following options:

- Condition - Choose what’s mapped to the display text and (optionally) color:

- Value - Specific values

- Range - Numerical ranges

- Regex - Regular expressions

- Special - Special values like

Null,NaN(not a number), or boolean values liketrueandfalse

- Display text

- Color (Optional)

- Icon (Canvas only)

To learn more, refer to Configure value mappings.

Thresholds

A threshold is a value or limit you set for a metric that’s reflected visually when it’s met or exceeded. Thresholds are one way you can conditionally style and color your visualizations based on query results.

For each threshold, set the following options:

To learn more, refer to Configure thresholds.

Field overrides

Overrides allow you to customize visualization settings for specific fields or series. When you add an override rule, it targets a particular set of fields and lets you define multiple options for how that field is displayed.

Choose from the following override options:

To learn more, refer to Configure field overrides.