Important: This documentation is about an older version. It's relevant only to the release noted, many of the features and functions have been updated or replaced. Please view the current version.

Candlestick

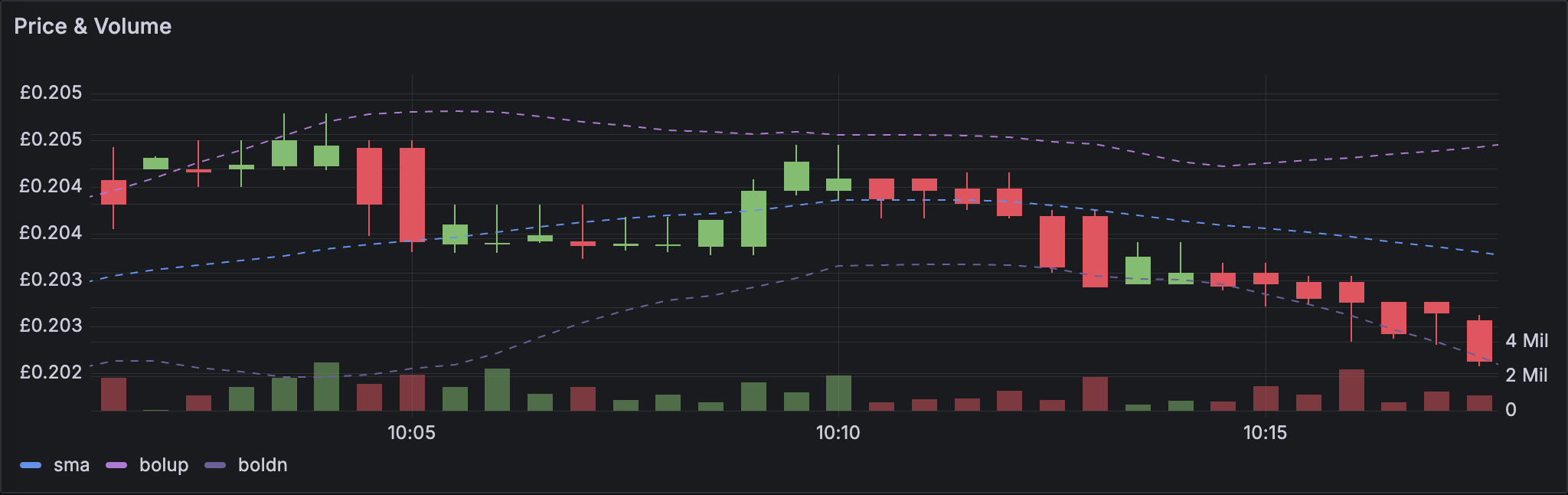

The candlestick visualization allows you to visualize data that includes a number of consistent dimensions focused on price movements, such as stock prices. The candlestick visualization includes an Open-High-Low-Close (OHLC) mode, as well as support for additional dimensions based on time series data.

Candlestick visualizations build upon the foundation of the time series visualization and include many common configuration settings.

You can use a candlestick if you want to visualize, at a glance, how a price moved over time, whether it went up, down, or stayed the same, and how much it fluctuated:

Each candlestick is represented as a rectangle, referred to as the candlestick body. The candlestick body displays the opening and closing prices during a time period. Green candlesticks represent when the price appreciated while the red candlesticks represent when the price depreciated. The lines sticking out the candlestick body are referred to as wicks or shadows, which represent the highest and lowest prices during the time period.

Use a candlestick when you need to:

- Monitor and identify trends in price movements of specific assets such as stocks, currencies, or commodities.

- Analyze any volatility in the stock market.

- Provide data analysis to help with trading decisions.

Configure a candlestick

Once you’ve created a dashboard, the following video shows you how to configure a candlestick visualization:

With Grafana Play, you can explore and see how it works, learning from practical examples to accelerate your development. This feature can be seen on Candlestick.

Supported data formats

The candlestick visualization works best with price movement data for an asset. The data must include:

- Timestamps - The time at which each price movement occurred.

- Opening price - The price of the asset at the beginning of the time period.

- Closing price - The price of the asset at the end of the time period.

- Highest price - The highest price the asset reached during the time period.

- Lowest price - The lowest price the asset reached during the time period.

Example

| Timestamps | Open | High | Low | Close |

|---|---|---|---|---|

| 2024-03-13 10:05:00 | 0.200 | 0.205 | 0.201 | 0.203 |

| 2024-03-14 10:10:10 | 0.204 | 0.205 | 0.201 | 0.200 |

| 2024-03-15 10:15:10 | 0.204 | 0.205 | 0.201 | 0.200 |

| 2024-03-16 10:20:11 | 0.203 | 0.203 | 0.202 | 0.203 |

| 2024-03-17 10:25:11 | 0.203 | 0.203 | 0.202 | 0.203 |

| 2024-03-18 10:30:12 | 0.202 | 0.202 | 0.201 | 0.201 |

The data is converted as follows:

Mode

The mode options allow you to toggle which dimensions are used for the visualization.

- Candles limits the panel dimensions to the open, high, low, and close dimensions used by candlestick visualizations.

- Volume limits the panel dimension to the volume dimension.

- Both is the default behavior for the candlestick visualization. It includes both candlestick and volume visualizations.

Candle style

- Candles is the default display style and creates candle-style visualizations between the open and close dimensions.

- OHLC Bars displays the four core dimensions open, high, low, and close values.

Color strategy

- Since Open is the default behavior. This mode will utilize the Up color (below) if the intra-period price movement is positive. In other words, if the value on close is greater or equal to the value on open, the Up color is used.

- Since Prior Close is an alternative display method based where the color of the candle is based on the inter-period price movement or change in value. In other words, if the value on open is greater than the previous value on close, the Up color is used. If the value on open is lower than the previous value on close, the Down color is used. This option also triggers the hollow candlestick visualization mode. Hollow candlesticks indicate that the intra-period movement is positive (value is higher on close than on open), filled candlesticks indicate the intra-period change is negative (value is lower on close than on open). To learn more, see the explanation of the differences.

Up & Down Colors

The Up color and Down color options select which colors are used when the price movement is up or down. Please note that the Color strategy above will determine if intra-period or inter-period price movement is used to select the candle or OHLC bar color.

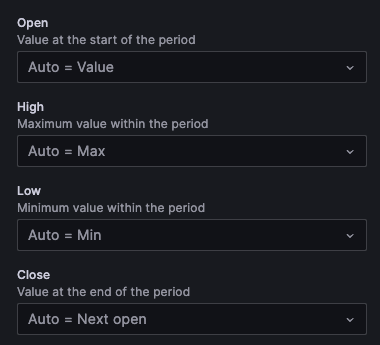

Open, High, Low, Close

The candlestick visualization will attempt to map fields to the appropriate dimension. The Open, High, Low, and Close options allow you to map your data to these dimensions if the panel is unable to do so.

Note

These values are hidden from the legend.

- Open corresponds to the starting value of the given period.

- High corresponds to the highest value of the given period.

- Low corresponds to the lowest value of the given period.

- Close corresponds to the final (end) value of the given period.

- Volume corresponds to the sample count in the given period. (for example, number of trades)

Note

The candlestick visualization legend doesn’t display these values.

If your data can’t be mapped to these dimensions for some reason (for example, because the column names aren’t the same), you can map them manually using the Open, High, Low, and Close fields under the Candlestick options in the panel editor:

Additional fields

The candlestick visualization is based on the time series visualization. It can visualize additional data dimensions beyond open, high, low, close, and volume The Include and Ignore options allow it to visualize other included data such as simple moving averages, Bollinger bands and more, using the same styles and configurations available in the time series visualization.