How KCB Bank Uganda greatly improved transaction service monitoring with Grafana

In 2019, KCB Bank Uganda reviewed its systems and came to a startling realization: Due to outdated monitoring processes, its services could be down for hours before anyone was alerted internally. This downtime led to frustrated consumers, a rise in customer service complaints, and a decline in revenue.

In a GrafanaCONline 2022 talk titled ”With Grafana, KCB Bank Uganda improved service uptime and has the tools to scale,” Systems and Software Engineer Fauzi Lutaaya shared how the company went from tracking application transactions like mobile banking and ATM services in Excel sheets to building a centralized monitoring tool that helped to dramatically improve service uptime.

Increasing service uptime with early warning alerts

KCB Bank operates in seven countries in East Africa, and until 2019, its Ugandan transaction systems were based in Kenya. To improve its systems’ reliability and cut resolution time on ICT incidents, the bank migrated those operations to Uganda and launched an initiative to monitor all critical application services 24/7 in a unified dashboard.

The initial version of this initiative met the dashboard goal, but it captured only 55% of system activity and was expensive to maintain, often needing code rebuilds for new additions.

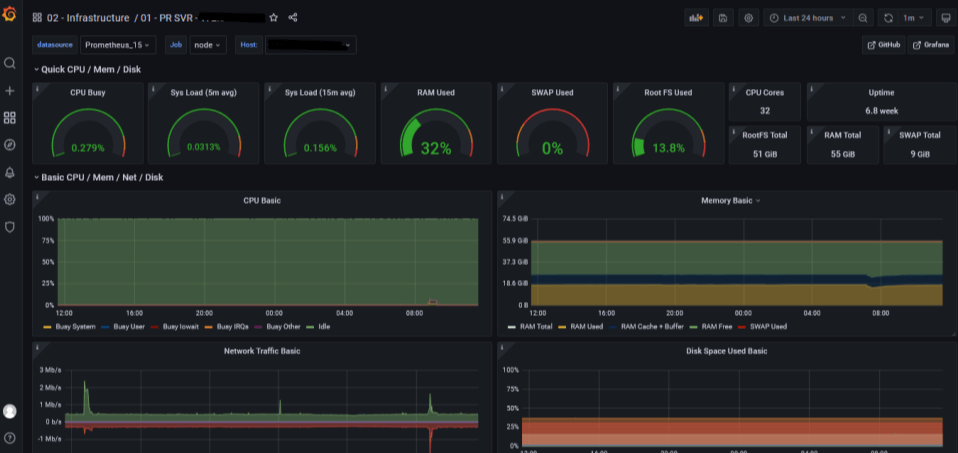

Enter Grafana. KCB Bank Uganda implemented Grafana OSS to monitor infrastructure for critical application services, provide real time messaging alerts, and produce visualizations (like pie charts and histograms) for transaction processing. After installing Prometheus on all operation and infrastructure systems, Lutaaya’s team implemented Grafana to capture all data sources, including Microsoft SQL Server and a JSON data source for querying enterprise data.

Taking inspiration from weather-related alerts, KCB Bank Uganda “designed multiple dashboards to house early warning metrics for each transaction and attached alerts to each metric,” says Lutaaya. With Grafana Alerting, the bank has full visibility into time-sensitive issues and administrators use Grafana playlists to view the entire ecosystem.

This ability to drill down into key granular items like system load or disk space on specific servers contributed to a 96% improvement in transaction service monitoring. “Consistent service uptime led to consistent revenue collection,” adds Lutaaya. “Our ledger started looking better.”

Scaling modern banking with Grafana dashboards

The wins KCB Bank Uganda experienced “opened up our eyes to new opportunities,” says Lutaaya. His team expanded their use cases and now use Grafana to analyze transaction trends in real time on business products and to monitor ICT infrastructure items like power generator fuel and CCTV footage.

They also added fraud detection to their list of Grafana-enabled capabilities. “We are doing ecommerce and doing more digitization compared to traditional banking, which brings more risks into our environment,” says Lutaaya.“[If a customer’s card is stolen and used] I can write a small script and track card activity from my database. We can then work with external people like local enforcement.”

Next on the list: a research project for using Grafana to invoke major actions like service restarts and service stoppage. All of this work improves the customer experience, but the efficiency gains have another added benefit. “I want the IT person to attend that nice social gathering and not be cooped in the office all of the time, but that does not mean the business should be left exposed. So with Grafana, we can write clever scripts, put on clever interfaces, and create a set of procedures around particular alerts,” says Lutaaya. “Before you know it, you are running better support with better convenience and the business is making money.”

Watch the full session to learn more about KCB Bank Uganda’s system architecture and see how it continues to implement Grafana across its operations. All our sessions from GrafanaCONline 2022 are now available on demand.